Dealerships both small and large are always looking for unique ways to generate additional revenue. In the age of competition and digital marketing, where every dealership with an internet presence has an equal voice, simply selling cars and providing high-quality repairs isn’t enough (however, it certainly does help you stand out from your competitors); you’ve got to explore every available avenue for additional profits.

As a dealership, you’re given the opportunity to submit to your manufacturer for retail reimbursement for your warranty parts as well as labor. With these submissions, you have the chance to increase your annual warranty parts gross profits by tens of thousands of dollars. Given that considerable number, your dealership no doubt wants to take advantage of this process, even if you aren’t completely familiar with the rules involved or the process for submission (and rebuttal, if necessary).

Let’s take a look at how your dealership can quickly and easily increase its profits without a lot of effort.

Understanding the Rules: Do-It-Yourself Submissions

Before you begin the submission process, understand that there are two types of submissions, factory and statutory, and two ways to complete it, through a third-party organization or on your own. Especially if you operate a small dealership with only a handful of employees and profits, you may be tempted to perform these reimbursement submissions on your own with the goal of saving money. After all, you learned the art of selling and maintaining cars in addition to running a business, so how hard can it really be to follow factory or statutory guidelines to earn more profits?

The answer, unfortunately, is very. Retail warranty reimbursement submissions aren’t as simple as following a couple steps on a form. Rather, each manufacturer will have its own set of rigid and complex rules that you’ll need to adhere to. And the bigger issue is that these rules often aren’t documented, so you won’t be able to reference them as you go about the submission process.

In addition to manufacturer rules, each state has specific laws regarding retail warranty reimbursement submissions. While these laws are public domain, they’re sometimes written entirely in obscure language, which, depending on your background, can be extremely difficult to accurately decipher and apply to your specific submission. Although you will be dealing with state statutes, this is by no means a “legal” matter; rather, it is about applying rules, both in the law and from your manufacturer. Just as important is the technology utilized, the quality of the audit team, the package review process, firsthand experience, and the knowledge of how to respond in case of a rebuttal.

Other Common Issues with DIY Submissions

Beyond the manufacturer rules and state laws, dealerships often run into several unanticipated issues when attempting to perform a submission on their own, such as:

- Who’s doing the submission? The submission process can be very time intensive. As a result, the team member tasked with performing the submission will likely be focusing on nothing else—no sales, customers, or car repairs—for however long it takes to be completed.

- How do you handle rebuttals from the manufacturer? Manufacturers will only listen to specific types of responses based on their objections or clarifications—if you rebut incorrectly, you risk losing out on more profit.

- How do you know what your optimal rate is? Your optimal rate is based on your work mix and the types of repairs that you perform. But without professional guidance, you can only guess at which sequence of repair orders to submit to earn your optimal rate.

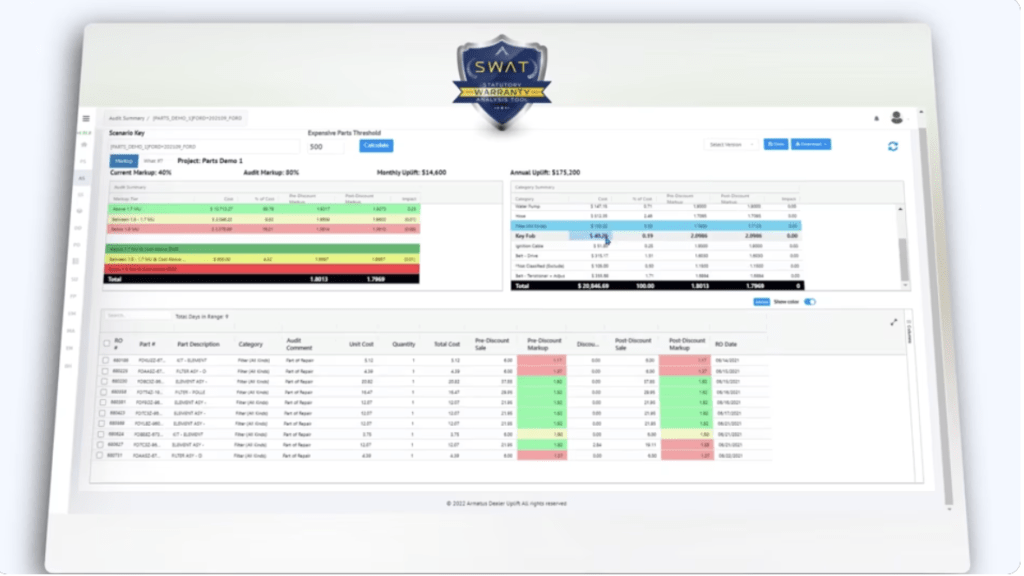

- What technology will you use? To perform an optimized submission, you’ll need an analytical database, not a spreadsheet application, to curate your information. This is because you want technology that will help you make accurate calculations for your best rate, not educated guesses.

As you can tell, many dealerships quickly learn that doing the submissions on their own ends up costing much more money and time in the long run, despite their original intentions.

The Inverse: Outsourced Submissions

By contrast, an outsourced submission is the inverse to all of the concerns we discussed above: experienced team members with extensive technical and operational backgrounds will handle the submission from start to finish; in the event of a response from the manufacturer, the third party has a litany of prior responses to draw upon based on their years of experience; they have knowledge of the current manufacturer’s behavior; these experts know what your optimal rate is; and they will use the most up-to-date methodology to submit your reimbursement package on your behalf.

In addition, because third parties are so versatile at performing a variety of reimbursement submissions, they can complete them much quicker than you’d expect—typically within 30 days, with little to no input required from you or your team. Furthermore, the results speak for themselves—dealerships that opt to outsource the submission process see a 10-to-30 point markup advantage over in-house submissions.

Take, for example, a past client. This dealer performed their own internal analysis and submission resulting in a 64% markup, which they were satisfied with. Then, the dealer principal was referred to our group by another dealer client. Our subsequent analysis revealed an additional opportunity for increased profit, so we submitted on their behalf and received manufacturer approval.

The result: a 96% factory-approved markup, which was 32 points higher than the original approved percentage, leading to an additional total gross profit uplift of $8,700 per month or $104,000 per year.

Final Thoughts

All of this information may sound too good to be true, and you might be wondering why you should trust your dealership’s information with an organization you’ve never worked with.

Before you choose to work with a new organization, we suggest you take a look at the company’s reviews and testimonials, endorsements from state associations, data governance protocols, and reputation in the industry. You should also look at organizations that don’t require payment before they’ve done any work; make sure they have “skin in the game” with you. From this research, you should be able to glean whether the company is worthy of earning your business.

Get in touch with Armatus Dealer Uplift by calling 888-477-2228 or email [email protected].

Author Bio: Joe Jankowski is the Managing Member of Armatus Dealer Uplift, a Hunt Valley, Maryland-based firm specializing in retail warranty reimbursement submissions. Joe has been personally involved in consulting on 21 retail warranty statutes and is widely recognized as a subject matter expert in this highly technical arena. Previously, Joe spent more than 20 years as CFO, COO, and CEO of a large automotive group in Maryland.